You're Likely Owed Funds...

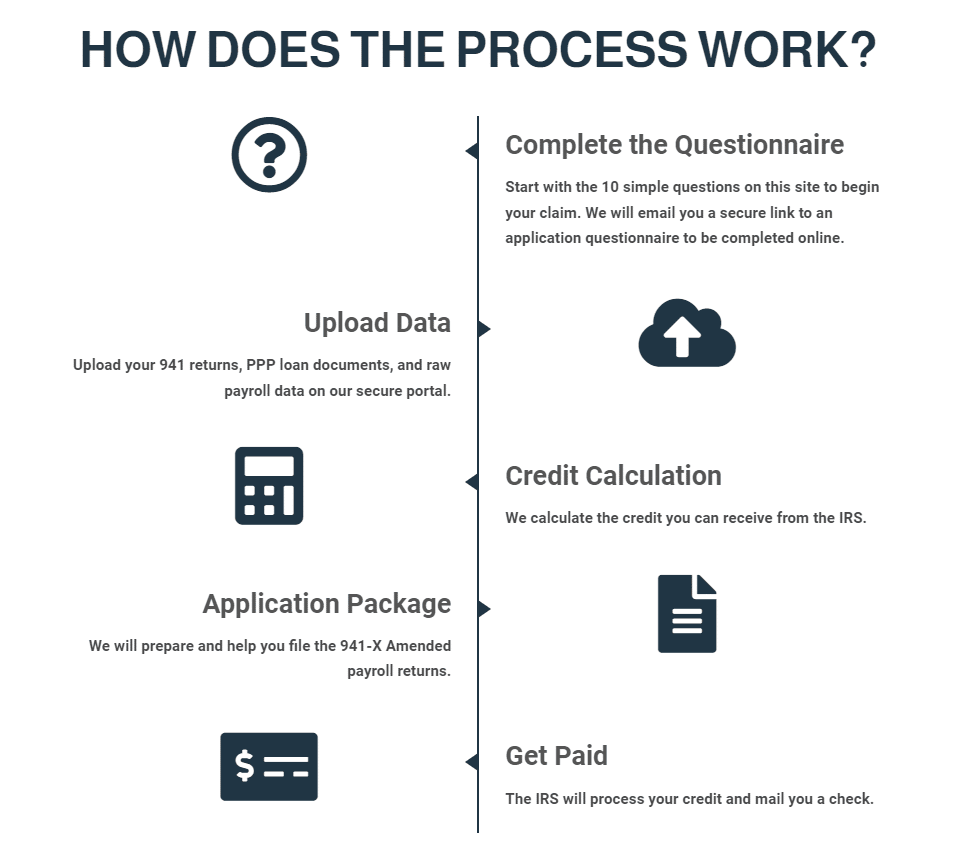

Many businesses qualify for Employee Retention Credits with a simple process that requires less than 15 Minutes of your time.

The Employee Retention Credit

Maximizing Your Claims For Keeping Americans Employed

The government has authorized unprecedented stimulus, and yet billions of dollars will go unclaimed.

Funded by the CARES Act

Billions of dollars are still available to claim!

The ERTC was established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and provides a credit equal to 50 percent of qualified wages and health plan expenses paid after March 12, 2020 and before Jan. 1, 2021.

A per-employee $10,000 maximum of qualified 2021 wages (Q1, Q2, Q3).

That is a potential of up to $21,000 per employee!

No Restrictions - No Repayment

This is not a loan and never needs to be repaid

While the ERTC was created in the CARES act along with the PPP Loans - this is not a loan, there is no repayment.

There are no restrictions for what recipients of the credit must use the funds.

Up to $26,000 Per w-2 Employee

Full Time and Part Time Employees Qualify.

The 2020 ERC Program is a refundable tax credit of 50% of up to $10,000 in wages paid per employee from 3/12/20-12/31/20 by an eligible employer.

That is a potential of up to $5,000 per employee.

In 2021 the ERC increased to 70% of up to $10,000 in wages paid per employee per quarter for Q1, Q2, and Q3.

That is a potential of up to $21,000 per employee.

Startups eligible for up to $33,000.

Free, No Obligation Pre-Qualification

Let our expert team determine if you qualify for a sizable rebate.

By answering a few, simple, non-invasive questions our team of ERTC experts can determine if you likely qualify for a no-strings-attached tax credit.

There is no cost or obligation to be pre-qualified.

What Is Employee Retention Credit?

The COVID-19 pandemic did not just shake the health sector. It left American businesses struggling to stay afloat and the global economy in crisis. Now, life is transitioning back to normal, and businesses have started opening their doors.

To assist businesses with financial recovery, the government introduced the Employee Retention Tax Credit (ERTC) program. Its goal is to help businesses that retained employees get back on track and secure their financial future during the pandemic.

Regardless of the benefits of ERTCs, the process can be very confusing, especially with the complexity of tax codes and qualifications. That’s where we come in.